Case Study: $1.85 Million to Buy an Insurance Agency Book of Business

The BankLink team matched this insurance agent with a lender to finance the purchase of a second book of business

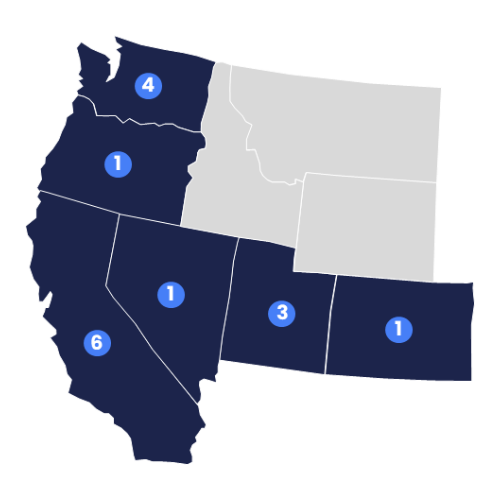

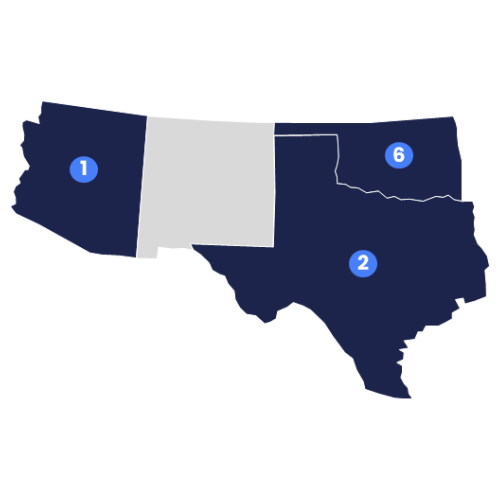

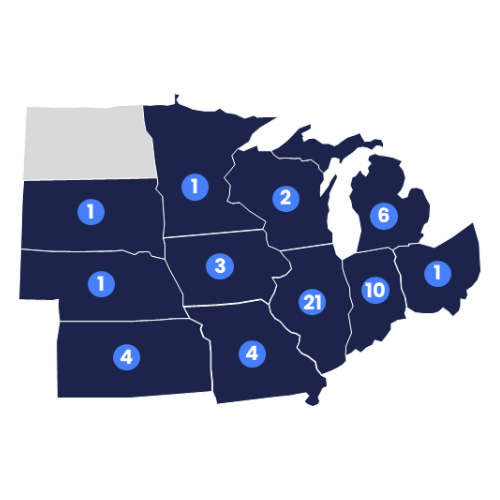

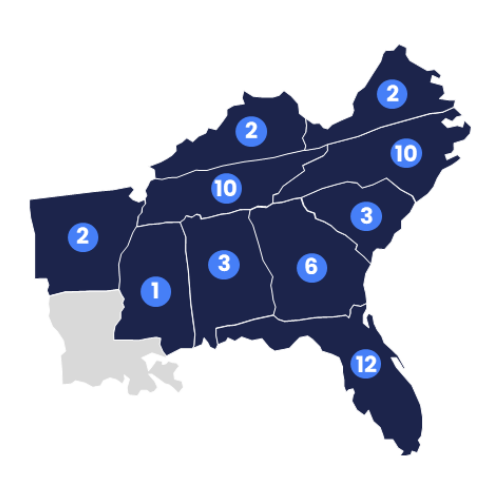

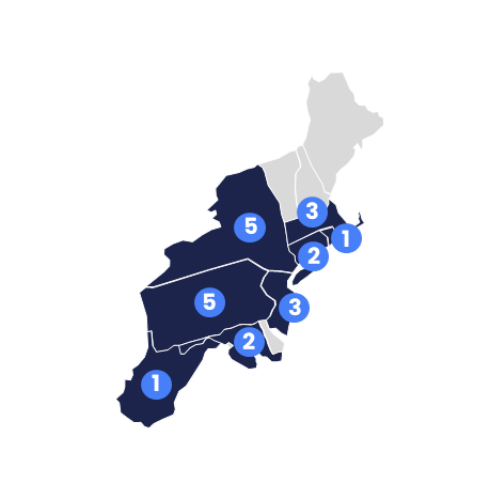

Match with a lender based on industry expertise, credit profiles, and project fit from our network of 140+ verified lenders in 36 states.

Extend your repayment terms and optimize your loan structure by tapping into competitive rates with no additional fees.

Access lending institutions in your area who understand your market and the unique challenges of your industry.

Work directly with a single loan processing team at Windsor Advantage from the get-go to streamline your lending experience.

Find a true financing partner, not just a lender. Our match process finds options suited to your industry and planned use of proceeds.

“Every business should have the capability to efficiently assess all of its lending options.

Our team at Windsor Advantage created BankLink to cut through all of the online noise and provide borrowers with a clear and personalized approach to securing capital.”

– Michael Breckheimer, President & CEO of Windsor Advantage, LLC

Our process streamlines the process of qualifying for a business loan. Windsor BankLink experts review your information and match you with the lending sources most likely to fund your business.

Step 1: Apply Online (5 min)

Step 2: Talk to An Expert (30 min)

Step 3: Match (2-3 Days)

Step 4: Apply (15 Minutes)

With 140+ lenders headquartered in 36 states, we help find your perfect match to an experienced SBA lending institution.

The BankLink team matched this insurance agent with a lender to finance the purchase of a second book of business

1. What is Windsor BankLink? Windsor BankLink is a new digital platform launched by Windsor Advantage, aimed at connecting business

DISCLAIMER: When you click Accept you will be leaving the Windsor BankLink website and are going to a website that is not operated by Windsor BankLink. We are not responsible for the content or availability of linked sites. ABOUT THIRD PARTY LINKS ON OUR SITE Windsor BankLink offers links to other third party websites that may be of interest to our website visitors. The links provided in our website are provided solely for your convenience and may assist you in locating other useful information on the Internet. When you click on these links you will leave Windsor BankLink's website and will be redirected to another site. These sites are not under control of Windsor BankLink. Windsor BankLink is not responsible for the content of linked third party websites. We are not an agent for these third parties nor do we endorse or guarantee their products. We make no representation or warranty regarding the accuracy of the information contained in the linked sites. We suggest that you always verify the information obtained from linked website before acting upon this information. Also, please be aware that the security and privacy policies on these sites may be different than Windsor BankLink’s policies, so please read third party privacy and security policies closely. If you have any questions or concerns about the products and services offered on linked third party websites, please contact the third-party directly.